Drill Baby Drill Crowd Eyes Alaska Refuge…Again February 3, 2011

Posted by Jamie Friedland in Climate Change.Tags: Alaska, Alaska Wilderness League, ANWR, Arctic, Big Oil, Lisa Murkowski, Oil

add a comment

New post at the new and improved Change.org:

It’s one of those immutable laws of American politics: When oil prices go up, lawmakers inevitably try to get their hands on the Arctic National Wildlife Refuge (ANWR). Ans as oil prices rise inexorably back near $100 per barrel, Big Oil’s favorite senator, Lisa Murkowski (R-Alaska), is at it again.

…

Year after year, we have to defend this unparalleled wilderness sanctuary and vital calving ground for the Porcupine caribou from Big Oil’s hired guns in Congress. It’s time to protect this iconic treasure once and for all.

The Alaska Wilderness League is leading the charge to have the Arctic National Wildlife Refuge designated as a National Monument. Sign their petition here and join more than 32,000 other Change.org activists to tell President Obama to finally secure this natural legacy from special interest exploitation—right now, the petition is just shy of the 35,000 signature benchmark.

Read the full post here.

Republicans Block Anemic Energy Bill for Oil Industry July 28, 2010

Posted by Jamie Friedland in Climate Change, Congress, Offshore Drilling, Politics.Tags: Clean Air Act, Congress, Energy Bill, EPA, Fracking, Harry Reid, Inhofe, Jay Rockefeller, Lamar Alexander, Lisa Murkowski, Mark Begich, Oil Spill, Politics, Senate, ThePoliticalClimate

1 comment so far

Despite the weakness of the pending oil spill/“energy” bills introduced in the House and Senate this week, Big Oil and their Congressional allies are doing everything they can to make sure we do not learn from BP’s unforgiveable mistakes.

100 days after the Deepwater Horizon spill began, Republicans oppose each of the small shuffles down the right path that these bills contain.

For example, anti-science champion Sen. Inhofe (R-OK) takes exception with a provision that requires natural gas drillers to merely disclose which toxic chemicals they are injecting into the ground near our drinking water supplies during the controversial practice known as “hydraulic fracturing” or “fracking.”

Why does Inhofe oppose the simple disclosure of that information? Because Inhofe and the industry claim that the dangers of toxic chemicals in drinking water are overblown.

Comprehensive energy reform is already dead, and even these bills, which could only euphemistically be called “half-hearted”, have a slim chance because Republicans claim that there is little room for compromise. That is a disgusting claim. These bills are already grotesquely compromised. They were so thoroughly watered down in hopes of attracting the necessary supermajority that they are scarcely progress at all. To demand more compromise calls to mind a limbo player lying on the floor.

Republicans most vehemently oppose lifting the liability cap on oil companies that defile our nation’s environment. They say that expecting oil companies to pay for the full consequences of the damage they cause will drive “mom and pop” oil companies out of business. That is hardly a defense of limited liability: if that claim is true, perhaps mom and pop should pursue less risky projects.

Republicans are fighting to preserve the apparent right of every oil company, big or small, to remain blameless for the oil spills they continue to cause in American waters. That is senseless.

With midterm elections approaching, Republicans are pretending to have solutions of their own; toward that end, they are circulating an even bigger joke of an energy bill. Their “alternative” bill contains energy “solutions” such as lifting the deepwater drilling moratorium and preventing the administration from blocking offshore drilling again. You know, the change we need.

However, the Republican bill does contain a provision that unfortunately may influence the Democratic bills. Instead of unlimited liability for oil companies that cause spills (making them pay for all the damage they cause), Republicans have a different idea: ironically, the party of limited government wants to make the Department of the Interior set liability limits on each individual rig based on 13 different criteria, including a company’s safety record and the estimated risks involved with the specific location.

This is just another way to protect Big Oil and make sure that taxpayers are the ones who have to pay to clean up oil spills. Oil state Democratic Senators Mary Landrieu (D-LA) and Mark Begich (D-AK) are attempting to broker a compromise on oil spill liability.

There is one additional point that must be mentioned. Many Republicans are trotting out this line in various forms:

“This is a serious subject and it deserves consideration by the United States Senate on behalf of the American people. We are ready for a serious debate, but it appears the Majority Leader is not.” –Sen. Lamar Alexander (R-TN)

This complaint is not just about the bill’s expedited timeline. It is true that Sen. Reid is trying to have an energy bill passed by the August recess. Yet perhaps more importantly, Sen. Reid is unlikely to allow any amendments to be added to this bill.

Such a parliamentary maneuver is necessary because Sen. Jay Rockefeller (D-WV) is poised with his amendment to delay the EPA’s authority to regulate carbon dioxide under the Clean Air Act; the final regulatory bulwark of climate action in the United States.

Rockefeller’s amendment, about which I will write more soon, is similar to Sen. Lisa Murkowski’s (R-AK) “Dirty Air Act” amendment that was narrowly defeated in June. If amendments were allowed, she too would certainly poison this bill with something similar. Indeed, Murkowski is considering adding the amendment to an unrelated small-business bill as she tirelessly does the bidding of Big Oil in the U.S. Senate.

Why the EPA Should Regulate Carbon July 7, 2010

Posted by Jamie Friedland in Climate Change, Coal, Congress, Politics.Tags: Alan Blinder, Carbon Regulation, Climate Change, Coal, Congress, EPA, Global Warming, Jim Inhofe, Lisa Murkowski, Politics, Senate, Tailoring Rule, The Political Climate

1 comment so far

…because the Senate won’t.

Despite what is shaping up to be the hottest year on record, the ongoing oil spill and pubic opinion polls showing that Americans are finally ready to address our entwined energy and climate crises, legislation remains blocked by the usual suspects: Republicans, lobbyists and perpetual election year politics.

Most people think that Congress is the governmental entity that ought to address an issue as sweeping as climate change. I agree. So do most congressmen – loudly.

Unfortunately, many those congressmen who angrily rant about the importance of congressional authority are the very same people blocking congressional action.

The Obama Administration has made it clear that it does not want to have to regulate greenhouse gas emissions through the Environmental Protection Agency. Everybody would prefer that Congress pass a bill instead. The House has. The Senate, it seems, cannot.

Yet we must address a threat of this magnitude. So if Congress won’t, the EPA should. The Supreme Court agrees; if Congress doesn’t act, the EPA is legally obligated to regulate GHGs as a pollutant under the Clean Air Act. The EPA will not supersede legislative climate action; it will act in accordance with the Clean Air Act (written by Congress) unless Congress passes a newer law.

As the chances for such a law fade, it is worth examining what EPA carbon regulations might look like.

What Would EPA Regulations Looks Like?

There have been a number of bureaucratic hoops to jump through on the road to EPA carbon regulations. Next January, when the EPA’s new gas mileage standards for cars comes into effect, greenhouse gases will finally be “subject to regulation” under the Clean Air Act.

First, new polluting power plants and industrial facilities would have to adopt the “best available control technologies” (BACT) for regulating carbon emissions. The EPA gets to determine which technologies are “best.” Carbon capture and sequestration technology could fall into this category if it was proven, but that’s a long way off. In the meantime, the EPA would the mandate the use of existing technologies to reduce emissions and/or increase efficiency.

For example, the EPA could require any and all new coal-fired power plants to utilize integrated gasification combined cycle (IGCC) technology. IGCC plants convert coal into a synthetic gas so that it can be burned more cleanly (in terms of non-GHG pollutants) and use excess heat from the primary combustion and generation to power a secondary steam turbine that generates extra electricity per unit of coal burned. Or it could require new power plants use natural gas instead of coal.

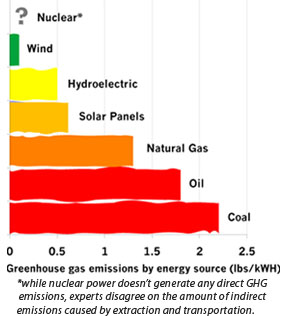

Natural gas emits much less carbon than coal. It’s not a long-term solution, but significant short-term gains could be achieved by switching from coal to natural gas. The EPA could propose this change.

What is the “Tailoring Rule”?

Under the Clean Air Act, anyone trying to build or upgrade a facility that will emit a baseline level of a regulated pollutant (usually 100-250 tons per year) needs to get a permit from the EPA certifying that they are utilizing the “best available control technology” (BACT) to minimize their emissions.

For other Clean Air Act pollutants, like lead, 100 tons per year is quite a bit and well worth of regulation. The problem here is that carbon emissions are on a much larger scale. As the Clean Air Act is written, as many as 6 million buildings would need permits for their carbon emissions, including schools, churches, buildings that use heating oil…you get the idea. Not the real targets of these regulations.

In May, the EPA released its “Tailoring Rule” to limit the focus of the permitting process to facilities that release >75,000 tons of carbon dioxide per year and already apply for other Clean Air Act pollutant permits. This way, only the major polluters are subject to these regulations. The Tailoring Rule brings down the number of regulated buildings from 6 million to about ~550 of the biggest polluters.

For the record, when originally proposed, the cutoff was set at 25,000 tons per year, but after the comment period, the EPA realized that too many buildings would be unintentionally regulated (like schools and small businesses).

Additionally, any new power plants expected to emit more than 100,000 tons of GHGs per year would need to get a permit. This would certainly cover all new coal plants, whose emissions are on the order of million of tons per year.

If the EPA does end up implementing these regulations, conservative groups such as the U.S. Chamber of Commerce will likely challenge the Tailoring Rule in court so that schools etc. would need be regulated as well. Why? Because they hate children. …ok fine, because if the EPA enacts this policy, conservatives want it to become a regulatory nightmare. Making the EPA permit the 6 million buildings that emit much smaller amounts of carbon each year would be impossibly cumbersome and cause considerable public backlash – so conservatives hope we would just scrap the whole thing and let them keep polluting for free. Potential legal vulnerabilities such as this are a weakness of this less than elegant regulatory route.

Benefits of EPA Carbon Regulations

EPA regulations would hopefully be designed with less lobbyist influence than in Congress.

Most climate/energy bills – including the climate bill that pass in the House last year – end up “grandfathering” in some dirty coal plants. That is, their emissions are exempted from regulation. Such provisions completely undercut the energy bills that contain them by providing utilities with a perverse incentive to keep their oldest, most polluting plants open as long as possible. They are written by lobbyists and exist solely as thank you’s from American legislators to their industry supporters.

Disgustingly, even the original Clean Air Act grandfathered in existing coal plants.

Everything Congress touches that is at all energy-related comes out blackened with soot and covered in tar balls. The EPA is not impervious to industry demands, but it is certainly in a better position to stand up to industry than Congress (which isn’t saying much).

In fact, in many ways,

The EPA is Better Suited to Address this Issue than Congress

In 1997, economist Alan Blinder presented an interesting argument that some governmental challenges could and should be better solved by unelected experts.

Certain types of problems, Blinder correctly argued, are by nature better addressed by experts than by elected laymen in Congress. These types of problems meet three criteria (discussed below):

- The issue deals with technical subjects requiring specialized knowledge.

- The issue is long-term, both in problems and solutions.

- The issue imposes short-term hardship to avert long-term hardship of much greater magnitude.

Consider the legislative challenges of issues that meet these criteria. What follows are not critiques of our democracy but rather explanations of some unfortunate effects that institutional design can have upon policymaking.

Congress Lacks Specialized Knowledge:

Everybody knows that our elected representatives are not experts. They are elected to represent us and cannot possibly be expected to have in-depth knowledge of all the issues our legislature must tackle.

To overcome this deficiency, they summon experts to testify before them. But most testimony has little impact on legislation, and as anyone who has ever watched C-SPAN (or even the Daily Show) can tell you, sometimes “expert testimony” is nothing short of political theater.

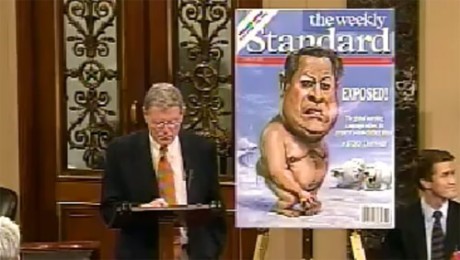

For example, in 2005, the notorious Sen. James Inhofe (R-OK and Congress’s most vocal climate-denier), who at the time chaired the Environment and Public Works Committee, invited fiction author Michael Crichton to advise the Senate on climate science because he had recently written State of Fear, a fictional story about murderous eco-terrorists. Inhofe also made that book “required reading” for members of the top Senate environmental committee.

When you hear about the final deal-making and compromises being made to pass a law, it has nothing to do with expert testimony or pure policy considerations – it’s often just about pork barrel politics and a particular legislator’s demands.

It is easy to see why under certain circumstances, our country would be better served if experts in the field at hand were asked to craft sensible and efficient policies to address technical problems.

Congress Cannot Address Long-Term Problems:

It is never more than two years from an election year in Washington. If congresspersons want to be reelected, they need to deliver short-term results to their constituents.

It is no surprise, then, that long-term problems are not legislative priorities; they appeal to our legislators’ responsibility and duty, but those are not the forces that drive Washington.

Even if addressing a long term problem did not cost anything today, it would present an opportunity cost because a House representative only has 2 years to deliver demonstrably for his constituents.

For long term solutions that have short term costs, the future prospects grow bleaker. Add a degree of uncertainty and magnify it with disinformation and demagoguery, and it is obvious why climate bills are hard to pass.

Congress Cannot Impose Short-Term Costs for Long-Term Benefits:

Legislators are held accountable for the present, not the future. Until the end of their careers, the desire for reelection prioritizes short-term considerations. Think about a Representative in the House. If a bill in the House could save his constituents money in 10 years but will cost them money this year, he would have to be reelected 5 times before his constituents would feel the actual benefits of that bill, but he would surely be held responsible for the cost.

If that representative’s constituents are totally on board with that bill, they may give him credit for his work in the short term. But if it’s a contentious law and there is disinformation circulating, that vote could well cost him his job.

If the problem that bill solves is only a small one today, even if it’s going to get much bigger in the future, his constituents may resent him for imposing a cost to solve a problem that was not unbearable yet. This is why Congress is a reactive, not proactive, body.

Climate change is a long-term threat with long-term solutions. Unfortunately, we only have a short-term window to address it and it will impose short term costs.

It is the perfect storm of an issue that Congress really cannot handle. It is exactly the type of issue that Alan Blinder was talking about. That is why the responsibility of carbon regulation may well fall to the EPA.

Downsides to EPA Action

1. Limited Scope: EPA regulations, at least early on, would do very little to clean up our existing power plants. Recall from the Tailoring Rule that these regulations apply only to new or upgrading plants (unless they release other Clean Air Act pollutants too). Obviously, we would need to reduce our current emissions to meaningfully reduce our climate pollution.

2. Cost: Congressional action could achieve emission reductions more cheaply than the EPA regulations could. If EPA establishes carbon regulations under the Clean Air Act, they will be traditional “command and control” regulations. The EPA will dictate what emissions-reducing technologies are best, and mandate their use.

Instead of that approach, Congress could use more modern market-based initiatives like cap-and-trade to put a price on carbon. This would spur innovation and let us achieve our emission reductions for less. The EPA would mandate the use a current technology, with no incentive to develop better ones.

The cost factor and other differences between market-based initiatives vs. command and control regulations are outlined in this recent post.

3. It’s Not Enough: EPA carbon regulations would provide emissions reductions where we need them most – the energy sector. But they couldn’t put a price on carbon, which is a vital step to achieving the long-term reductions necessary to avert the worst effects of climate change.

“The only way to cut emissions 80 percent by 2050 is to put a price on carbon, and the only folks who can do that are in Congress.” –David Bookbinder, Sierra Club.

4. Threat of Being Overturned: Legal challenges could slow the EPA process but probably not derail it altogether. The real threat is that Congress could overturn anything the EPA does, as Lisa Murkowski has already attempted to do preemptively.

Conclusion:

By virtue of not having gone through Congress, EPA climate regulations would likely emerge looking more like a sound policy solution than anything Congress has ever produced. However, these regulations would not be enough. Combined with a good energy bill, they could be part of a real solution, but we would still need some congressional action to truly address this threat.

A comprehensive climate/energy bill would be preferable to EPA regulations. But if Senate conservatives block another climate bill, the EPA will take action. It will at least be a long overdue step in the right direction.

A Eulogy for Cap-and-Trade July 1, 2010

Posted by Jamie Friedland in Climate Change, Coal, Congress, Politics.Tags: Cap and Trade, Carbon Tax, Congress, Energy Tax, Environmental Regulation, Flip-flopping, Global Warming, Greenhouse Gases, John McCain, Lindsay Graham, Lisa Murkowski, Political Climate, Politics, Republicans, Richard Lugar, Scott Brown, Senate, ThePoliticalClimate

1 comment so far

Although it appears that immigration is cutting in front of energy on the legislative agenda, earlier this week, President Obama told Congress that he wants an energy bill that puts a price on carbon and reduces greenhouse gas emissions by the end of this year.

Cap-and-trade is the best way to accomplish this goal. That is why the House passed the Waxman-Markey American Clean Energy and Security Act over a year ago. Yet pundits have long ruled this elegant policy tool dead.

At this point, it seems that only a sea change within the Senate could ever bring cap-and-trade back again. Before it receives its final judgment, it’s worth taking a look back at how this all started, how we got here, why it seemed like a good idea at the time, and why it still is.

Tom Crocker conceived of the cap-and-trade system as a graduate student at the University of Wisconsin in the 1960s. In the 1990s, it was applied with great success to control sulfur dioxide emissions from American coal plants that were producing acid rain. Our sulfur dioxide cap-and-trade system achieved greater reductions than expected at less than half the projected cost. The Economist dubbed it “probably the greatest green success story of the past decade” in July 2002.

Here in the US, cap-and-trade efficiently reduced sulfur dioxide emissions for a fraction of the projected cost.

The EU implemented a greenhouse gas cap-and-trade system in 2005 with mixed results. But it is a rare step in the right direction and a valuable first try from which we can learn many important lessons. To co-opt a Republican oil spill talking point, one plane’s turbulence shouldn’t preclude air travel. We can rebuild it. We have the technology.

A number of key Republican senators have stated that they will never vote on any energy policy that includes cap-and-trade. This is an unabashed flip-flop for which they have not been held accountable. Many of these senators supported cap-and-trade before they started calling it a “job-killing energy tax.”

Point of clarification for Republicans: carbon dioxide is not energy. It is a waste product and pollutant being dumped into a vital resource. Cap-and-trade is no more an “energy tax” than charging people who pumped cow manure into our drinking water would be a “beef tax.” Also, it creates jobs. Other than that though, “job-killing energy tax” is a perfect characterization.

Recent cap-and-trade “debates” have lacked relevant historical context; in 2003 John McCain cosponsored the first climate cap-and-trade bill, for crying out loud. The theory remains unchanged, the only new development is these senators’ adherence to Republican lies talking points. Blatant, partisan flip-flops are well-documented by McCain, Richard Lugar, Lindsay Graham, Scott Brown, and even Lisa Murkowski!

For decades, conservatives railed against “heavy-handed” traditional environmental regulations. Known as “command and control” regulations, these laws mandate one solution for a given problem, regardless of the circumstances. For example, if a factory emits too much of a given pollutant, by law it must install a specific type of scrubber to reduce that pollution, even if cheaper alternatives could produce that same emissions reduction.

While appropriate in many situations, economists and conservatives have argued against such regulations because they can be inefficient and impose higher costs than necessary upon businesses. This is a valid criticism. It is the reason why economists prefer and advocate for “market-based instruments” (MBIs) – such as cap-and-trade.

Market-based instruments, as their name implies, utilize markets for environmental regulation. They are preferable to command and control regulations because markets enable us to achieve emission reductions as efficiently (i.e. cheaply) as possible.

Command and control regulations stifle innovation. They mandate the use of a specific technology, and that is that. In contrast, MBIs foster and catalyze innovation. Cap-and-trade presents a great example.

Once we put a price on carbon pollution, it is suddenly within industries’ interest to invest in ways to cheaply reduce their emissions. Instead of dictatorially deciding what technology to use, we unleash our nation’s intellectual resources upon this challenge.

Under cap-and-trade, cheaper emission-reducing solutions are developed and utilized. And the benefits don’t just accrue for industry. Third parties stand to gain from developing these technologies for them, so MBIs incentivize the creation of startups and the expansion of small businesses attempting to reduce carbon output and increase efficiency – and obviously spur renewable energy technologies for our future.

But just how does cap-and-trade put a price on carbon?

If you know how a cap-and-trade system functions, you will want to skip to the last paragraph. If you’ve heard the phrase everywhere but aren’t really sure exactly what is entailed, I have provided a description here.

The Cap:

Regulators determine how much pollution the country is allowed to emit in a year. Then they distribute permits for emissions up to that amount (the distribution method is a complicating factor that I will discuss below). Because a fixed number of permits are issued, this system has the benefit of ensuring emission reductions (as opposed to a carbon tax). Polluters want to emit a given amount of pollution but there are only so many permits available. This creates a market for carbon pollution. That market puts a price on emitting carbon and also provides a long-overdue economic disincentive to pollute.

A carbon tax also puts a price on carbon, providing some but not all of these same benefits. A carbon tax is an inferior carbon control mechanism. If you are interested in why this is or dispute this point, I could easily throw together a cap-and-trade vs. carbon tax post.

The Trade:

Suppose, for example, that there are two factories (see the graphic below to visualize this example). One is ancient and spews pollution (Plant A) – making emission reductions at this factory is very expensive. The other is brand new and could easily be upgraded to drastically cut its carbon emissions (Plant B).

Under traditional, command and control regulation (left example), it would be very expensive to bring the older factory into regulatory compliance. Yet under a cap-and-trade system (right example), we could let the newer plant reduce its emissions for both itself and reduce its emissions further on behalf of the older plant.

In this cap-and-trade example, our polluters have permits entitling them to emit a certain amount of pollution. In this scenario, the newer plant emits even less pollution than it has permits for; it has cleaned up so much that it has permits to spare. So the older plant could pay the newer plant for offsetting its continued emissions (the newer plant sells its unused emission permits to the older plant).

Because paying the newer plant is cheaper than making further upgrades to the older plant would be, the same emissions reduction under command and control regulation is achieved for a fraction of the price using cap-and-trade. And the system operates efficiently because we allow the market to determine the price of the permits.

Permit Distribution:

How these pollution permits would be distributed is the biggest source of contention within cap-and-trade proposals. There are three ways to distribute credits:

1) Auction – companies bid for every one of the permits they think they need.

2) Allocation – the government gives away permits to polluters for free.

3) Grandfathering – permits are allocated based on historical emissions. This accomplishes nothing because there is no incentive to reduce emissions, but it has been lobbied for heavily by major polluters.

Serious cap-and-trade proposals have included a mix of these distribution options. From a climate change perspective, a pure auction is the best solution. It raises the most money to help offset costs to consumers and spur research and development of renewable energy technologies while providing the most incentive to reduce emissions. But direct allocations are attractive to legislators because it lets them in a sense “buy” the support of different groups that otherwise would not support the bill because they would be more greatly affected.

Some of this allocation falls into the realm of necessary political compromise, but it is also this aspect of previous climate bills that has doomed them in the contorted, propagandized public perception. That being said, instituting a cap-and-trade system without any initial allocation would impose heavy costs on industry all at once. I’m not saying they don’t deserve to pay for the free ride they have enjoyed for centuries, but helping them make the transition is not an outlandish idea.

Conclusion:

In any case, this all may be a moot point because cap-and-trade’s prospects in the Senate are beyond dim as long as Republicans stick to those guns they love so much and Democrats do not control a supermajority (and probably still even then).

I wrote this post because as this policy dies at the hand of partisan politics, it needs to be said that this was our best vehicle to address climate change. Study after study have shown that cap-and-trade bills would tackle our climate pollution while reducing the deficit, creating jobs, and increasing our energy security.

But who wants that? Not Republicans, apparently.

Oil Spill Legislation Pt. 2 June 22, 2010

Posted by Jamie Friedland in Congress, Offshore Drilling, Politics.Tags: Bernie Sanders, Big Oil, BP, Chellie Pingree, Chuck Schumer, Congress, Frank Lautenberg, House of Representatives, John Conyers, Lisa Murkowski, Mark Begich, Offshore Drilling, Oil, Pat Leahy, Senate

3 comments

Now that I have devoted two recent posts to what Congress isn’t doing, it’s time once again to look at what little they actually are working on. There are a couple of interesting pieces of oil spill legislation that have been introduced recently. These are the most noteworthy:

Let’s start with the bad ones.

S. 3461, introduced by David Vitter (R-LA) on 6/9. This bill would create a system for resolving claims against BP, which is fine. But it also seeks to renegotiate BP’s lease on “Mississippi Canyon 252” (where Deepwater Horizon was drilling when it sank).

Lease renegotiation is the Republicans’ preferred vehicle to increase BP’s liability. It has two main problems:

1) It requires BP’s cooperation. In order for this to work, BP would have to say, “Ok, we admit unlimited liability.” As TPM reported, BP could refuse or even simply walk away from the renegotiation talks. Public pressure might prevent them from doing this, but there is no guarantee. And certainly no good reasons to choose this over just lifting the liability cap, which takes us to the second point.

2) Lease renegotiation establishes no future precedent for oil spills. It is the legislative embodiment of not learning from our mistakes. If we pass this bill and no other, the $75 million liability cap will still be on the books when the next catastrophic oil spill occurs. This is why the only cosponsor on this bill is oil industry lackey Lisa Murkowski (R-AK). Her co-sponsorship indicates that this bill is supported by the oil industry, which in turn indicates that this bill is far too weak.

Also, it could violate the Constitution.

S. 3497, introduced by Scott Brown (R-MA) on 6/16. This bill would “require leases under the Outer Continental Shelf Lands Act to include a plan that describes the means and timeline for containment and termination of an ongoing discharge of oil.” The actual legislative text is not available yet, so I don’t know exactly what this bill would require, but that this seems weak to me. Oil companies saying “and it’ll take us 4 months to fix this thing if it blows” would seem to satisfy the requirements of this bill, nor does this appear to address the strength and efficacy of the oil company plans – is there anything in here to prevent them from submitting plans to protect walruses in the Gulf of Mexico again?

Scott Brown has offered no evidence that his is to be trusted on energy/environmental issues. That being said, he has found a bipartisan cosponsor for this bill in Dianne Feinstein (D-CA), so we will have to wait and see what is actually in this bill.

Now, the good stuff:

S. 3514: Amends the Outer Continental Shelf Lands Act to prohibit anyone from buying an oil or gas lease unless they pay into an Oil Spill Recovery Fund (unspecified amount so far) or post a bond equal to half of their outstanding liability related to oil spills or cleanups. If the payment into the recovery fund is low, then what appears to be the intent of the bill – prevent companies in BP’s current situation from expanding their operations before paying up for oil spills – may be undercut. But the legislative language is not available yet, so we’ll see. Introduced by Mark Begich (D-AK) on 6/21 with 2 cosponsors.

S. 3492: In light of negligent emergency planning and the failure of all other containment options, this bill would amend the Outer Continental Shelf Lands Act to require leaseholders to prepare for and actually drill at least one relief well concurrent to the drilling of any exploratory well in the Outer Continental Shelf (OCS). The bill allows for “alternative measures” at least as effective as a relief well to be employed instead of a relief well as authorized by the Secretary of the Interior. Probably unlikely to pass, but an interesting idea. Introduced by Frank Lautenberg (D-NJ) on 6/15 with no cosponsors yet.

H.R. 5513: “Spilled Oil Royalty Collection Act.” Oil companies pay royalties on each barrel of oil produced. In the “unforeseeable” event of a deepwater oil spill (defined as depth > 200m), this bill would charge oil companies royalties of at least 12.5% on every barrel that comes out of the well, regardless of whether that oil is recovered, burned, “dispersed”…anything. This bill would come into effect retroactively, right before the Deepwater Horizon explosion. Were this to become law, it would further highlight the importance of accurate flow estimates for gushers. Those royalties would certainly not offer much more deterrent than legal liability, but can you think of any reason that spilled oil should be exempted from royalties? I can’t. Especially because they are recovering and selling some of it. Introduced by Chellie Pingree (D-ME) on 6/10 and has 2 cosponsors.

H.R. 5503: Amends the 90-year-old “Death on the High Seas Act” to make it easier for those such as the families of the 11 workers who died in the Deepwater Horizon explosion to sue for non-pecuniary losses such as pain and suffering. The bill was introduced with a statement that read, “We should not allow reckless corporations to use 19th century laws to shortchange their victims.” Sounds right to me. Introduced by John Conyers (D-MI) on 6/11 and has 12 cosponsors.

The companion bill in the Senate (S. 3463) was introduced by Patrick Leahy (D-VT) first, on 6/8, and has 5 cosponsors.

S. 3478: Would repeal parts of the Limitations of Liability Act of 1851, which Transocean has invoked to attempt to cap its liability at about $27 million. This bill wins my personal award for Most Forced Acronym as its name is the “RESTORE Act,” which is supposed to stand for “Remuneration for Ecological and Societal Tolls Occasioned by Reckless Errors.” Introduced by Chuck Schumer (D-NY) on 6/10 and has 3 cosponsors.

Bills to raise the liability cap:

S. 3472: “Big Oil Bailout Prevention Unlimited Liability Act.” Completely lifts the standing $75 million liability cap for oil spills. Introduced by Robert Menendez (D-NJ) on 6/9 and has 24 cosponsors.

H.R. 5520: Requires BP to pay at least $25 billion to a fund like the escrow the White House negotiated, but goes further by excluding this spill from the liability cap. Introduced by Steve Kagen (D-WI) on 6/14 and has 32 cosponsors.

Bills to lift the deepwater drilling moratorium, which I fully support and have defended at length.

Senate:

S.3489: Introduced by David Vitter (R-LA) on 6/15 and has 1 cosponsor.

House:

H.R. 5499: Introduced John Mica (R-FL) on 6/11 and has 13 cosponsors.

H.R. 5525: Introduced by Pete Olson (R-TX) on 6/15 and has 28 cosponsors.

H.R. 5519: Introduced by Bill Cassidy (R-LA) on 6/14 and has 43 cosponsors, including some notable Gulf Democrats such as Charlie Melancon (D-LA). Apparently Bill is more popular than John and Pete.

Sanders Amendment Defeated

Also worth mentioning but filed again under what Congress isn’t doing: Sen. Bernie Sanders (I-VT) introduced an amendment to cut $35 billion in oil and gas royalties that don’t even add anything to the industry and would instead use $25 billion to reduce the deficit and $10 billion to encourage energy-efficient buildings. The amendment was first blocked by climate-denier Sen. Jim Inhofe (R-KY) and then defeated in a vote, 61-39.

Full list of oil spill questions and answers here.

New Oil Spill Legislation May 13, 2010

Posted by Jamie Friedland in Congress, Offshore Drilling, Politics.Tags: Anh Cao, BP, Congress, Crist, Deepwater Horizon, House of Representatives, Lisa Murkowski, Mark Begich, Oil, Oil Spill, Sen Menendez, Sen Murkowski, Senate, Sheldon Whitehouse, Whitehouse

4 comments

***UPDATE***

It looks like I missed one relevant Senate bill in my sweep yesterday: S. 3309. On May 6, Sen. Lisa Murkowski (R-AK) cosponsored legislation with Sen. Mark Begich (D-AK) that would raise the tax on oil producers that feeds the Oil Spill Liability Trust Fund to 9 cents/barrel (ooooh, 9 whole cents!).

Then, having made her token gesture of rebellion against her oil industry sponsors, Murkowski (R-OIL) single-handedly blocked the vote for Sen. Menendez’s bill that would raise oil company spill liability from $75 million to $10 billion. Way to look out for everyday Americans/Alaskans, Lisa.

For a second there I thought I might actually have to praise Murky for taking a small step in the right direction. Dodged that bullet.

Original Post:

As slowly as Congress acts, 11 relevant pieces of legislation have been introduced since the Deepwater Horizon rig sank on April 22, 4 in the Senate and 7 in the House of Representatives. I have compiled a list of these bills and their stated purposes beneath this post (legislative text is not yet available).

The most significant bills are the three House bills seeking offshore drilling bans, one to protect the entire Pacific coast, one to protect all of the Atlantic and [whatever will be left of] the Gulf of Mexico, and one to prohibit new offshore drilling anywhere in U.S. waters.

Three more bills (2 Senate, 1 House) attempt to raise the liability cap on what oil companies can be made to pay for the oil spills they cause.

Two more bills fall under the “disaster response/assistance” category (the latter being sponsored by Sen. Landrieu to aid cleanup because that is the only aspect of this disaster that matters to the Senate’s “Handmaiden to the Oil Industry”.

Two more bills essentially penalize the oil industry. I could phrase that more delicately, but I think it’s justified (and, given their current, monstrous subsidies, Big Oil still comes out way ahead). One bill proposes a fee on all oil leases to create a fund that will be used for pollution control and “to reduce our dependence on oil” which presumably would fund research or renewable energy.

The other, called the “USE IT Act,” puts a “production incentive fee” on idle leases that oil companies hold but don’t drill on. This seems like a great idea and has been suggested before. 75% of all offshore leases lie unused. Between 2004 and 2008, oil and gas companies received 28776 permits on public land. They drilled 18,954 of them. During Bush’s second term, Big Oil stockpiled nearly 10,000 leases. That is why calls for more lease sales are so ridiculous; Big Oil is sitting on plenty of untapped reserves. Each additional sale is just a land grab. Why not incentivize them to develop the reserves we have given them?

If you’ve been counting, you know that leaves 1 remaining bill. To paraphrase Sesame Street, “one of these bills is not like the others.” Only one of these bills was sponsored by a Republican. And it shows. Rep. Anh “Joseph” Cao (R-LA) introduced a slightly twisted bill on Wednesday. In a letter explaining his bill, he calls upon Congress and the administration not to repeat Bush’s mistakes and mount an effective response to this threat:

“Five years ago, the federal government failed us during Hurricane Katrina. I will not stand by and let the government fail us again.”

So far so good. Then he makes a questionable leap:

“An effective response will require both short-term emergency action and long-term investment. That is why I am drafting legislation to call for accelerated oil revenue sharing with the federal government.”

When he says, “sharing WITH” he really means “sharing FROM.” Revenue-sharing is the legislative mechanism through which Big Oil buys off coastal states (with federal money) so that they will accept the now obvious risks of offshore drilling. I understand the argument that the states, in foolishly accepting these risks, may deserve a cut of the leasing money. That is not my primary point here.

Unless this bill explicitly stipulates that transferred oil revenues will be earmarked for disaster mitigation or preparedness, it is a pretty despicable money grab and decidedly untimely gift to the oil industry. The only definite impact of this bill will be to shore up the currently threatened political support for offshore drilling in Gulf states.

The underfunding of state governments is not what will make this disaster so catastrophic. BP has claimed it will foot the bill and all available state and federal resources are already being brought to bear to do what can be done. I could be reading this wrong, but this seems pretty low.

Finally, I have not yet written about the new Senate climate bill, but I would be remiss not to mention here that champions like Sen. Menendez (D-NJ) and Sen. Nelson (D-FL) made it clear that they will not support a climate bill if it supports offshore drilling. The current draft allows states to veto federal plans within 75 miles of their shores. It also allows neighboring states to veto the project IF a government study concludes that an oil spill could cause them “significant adverse ecological harm,” which looks pretty likely now, doesn’t it? This, at least, is a good sign. (Source: E&E Climate Wire, subscription required).

Also, Gov. Crist is calling for a special session to discuss a proposed constitutional amendment to ban offshore drilling off Florida’s coast. This move is part of his recent dive to the left now that he is running as an independent, but it would be an important move regardless of his motivations.

These are the bills that have been introduced so far:

Drilling Bans:

- “West Coast Ocean Protection Act of 2010” (H.R. 5213): to amend the Outer Continental Shelf Lands Act to permanently prohibit offshore drilling off the coasts of California, Oregon and Washington. Introduced by John Garamendi (D-CA) May 5.

- “No New Drilling Act of 2010” (H.R. 5248): to amend Outer Continental Shelf Lands Act to prohibit new OCS leasing for any drilling or mining. Introduced by Frank Pallone (D-NJ) May 6.

- H.R. 5287: to amend the OCS Lands Act to permanently prohibit offshore drilling on outer continental shelf in the Atlantic Ocean and Gulf of Mexico. Introduced Corrine Brown (D-FL) May 12.

Raising the Liability Cap:

- S. 3345: to remove the cap on punitive damages established by the Supreme Court in Exxon Shipping Company v. Baker. Introduced by Sheldon Whitehouse (D-RI) May 11.

- S. 3346: to increase the limits on liability under the Outer Continental Shelf Lands Act. Introduced by Sheldon Whitehouse (D-RI) May 11.

- “Big Oil Bailout Prevention Act of 2010” (H.R. 5214): to require oil polluters to pay the full cost of oil spills. Introduced by Rush Holt (D-NJ) May 6.

Drilling Penalties:

- S. 3343: to direct the Secretary of the Interior to establish an annual fee on Federal offshore areas that are subject to a lease for production of oil or natural gas and to establish a fund to reduce pollution and the dependence of the United States on oil. Introduced by Frank Lautenberg (D-NJ) May 11.

- “USE IT Act” (H.R. 5102): to direct the Secretary of the Interior to establish an annual production incentive fee on onshore and offshore lands that are leased but where production is not occurring. Introduced by Edward Markey (D-MA) Apr 27.

Disaster Response/Assistance:

- S. 3337: to establish a program to provide technical assistance grants for use in assisting individuals and business affected by Deepwater Horizon. Introduced by Mary Landrieu (D-LA) May 11.

- H.R. 5241: to establish a commission to investigate the causes and impact of Deepwater Horizon and evaluate and improve the response to such disasters. Introduced by Lois Capps (D-CA) May 6. More info here.

Republican Bill:

- H.R. 5267: to accelerate the amount of Gulf of Mexico oil and gas lease revenues shared with States. Introduced by Anh Cao (R-LA) May 12.